File Opening, File Management, Costs Disclosure and Billing Practices Policy

This policy sets out the procedures for the opening and conduct of client files, disclosure of costs to clients and cost recovery practices. It ensures compliance with the Legal Profession Uniform Law (LPUL), the Australian Solicitors’ Conduct Rules (ASCR), and other applicable legal obligations, while promoting transparency and trust in our relationships with clients.

This policy applies to all staff within the firm involved in opening client files, managing preparing cost agreements, disclosing costs, and handling cost recovery. It applies to all clients of the firm, unless specific exceptions are agreed to by the firm or required by law.

1. Retainer Instructions

2. Conflict of interest check

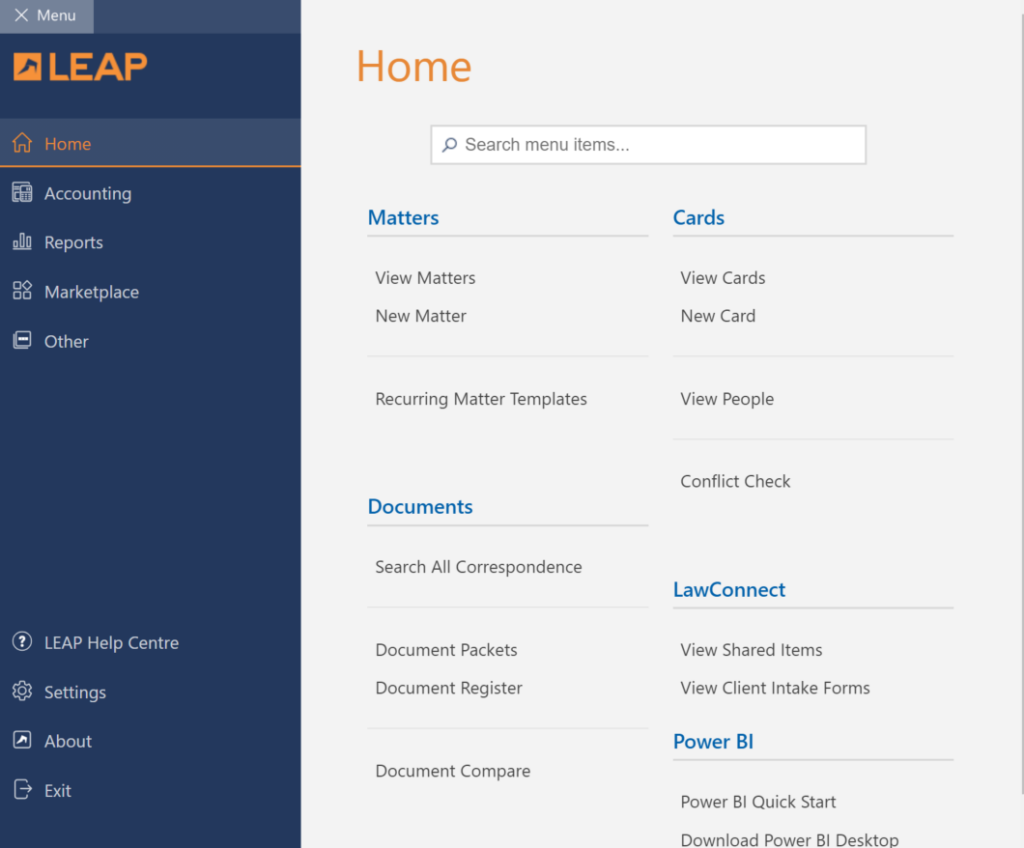

Completing a conflict of interest check in LEAP

- Select Conflict Checkfrom the LEAP Home menu and search the names of relevant parties. If the other party is a corporation or non-individual, search also the names of its directors and officers.

- If any conflict is discovered, refer the file to the Principal for instructions before proceeding further.

3. Opening a file

4. Disclose costs and disbursements in writing

5. Costs Estimates in Leap

6. Money up front on account of costs and disbursements

7. Invoices

8. Ongoing file Management

Incoming mail/emails

Outgoing mail/emails

Ongoing conduct of matter

9. File Notes

10. Compulsory client updates

11. Client complaints

12. Disbursements

13. Anti-money laundering procedures

Proof of source of funds(a) bank statements;

(b) recently filed business accounts; or

(c) other documents confirming the source of the funds, such as the sale of a house, a sale of shares, receipt of a personal injuries award, a bequest under an estate or a win from gambling activities.

14. Completion of a matter – Archiving

(a) Open the matter in LEAP.

(b) Verify that the matter status is either Complete or Not Proceeding. If it is neither, review the file for the correct date and update in LEAP.

(c) Check the Details & Correspondence tab for any comments needing attention.

(d) Check the Calendar & Tasks tab for any incomplete instructions, or any notations requiring follow up.

(e) Check only nil balances show in the accounting tabs.

(f) Check the Time & Fees tab to ensure no further bills are required.

(g) Check the Office Accounting tab to verify that the matter has been billed and that there are no outstanding balances.

(h) Check the Trust Funds tab to verify there is a nil balance.

(i) From the Details & Correspondence tab click on the 3 dots on the top right, and select Archive Management. Record the location of the physical file and the date of destruction which will be the completion date plus 7 years in most instances.

(j) On the hard copy file, record the Completion/Settlement date or the Not Proceeding date on the front and back of the file at the bottom.

(k) Record the file number at the top of the file on the back cover and on the side tab.

(l) Check the file for any documents that need to be returned to the client or moved to safe custody, so they are not destroyed.

(m) Scan and save a copy of any important documents to the LEAP matter.

(n) Ensure all documents remaining in the file are securely pinned to the hard copy file.

You can find the Retainer Instructions here.