When purchasing a property with another person you will at some point be asked about tenancy. This is legal jargon that simply relates to how you will be noted on the title as owning the property and as to what percentage of the property each owner will hold. The important question is what’s best for your situation. Joint tenants vs tenants in common?

What are the different types of Tenancy?

There are two different ways you can own a property with another person or persons:

Tenants in common or joint tenants.

It is important to know the differences between tenancy types when purchasing so that you can make the appropriate decision. There is time and expenses associated with changing a wrong decision.

Tenants in common vs joint tenants

Tenants in Common

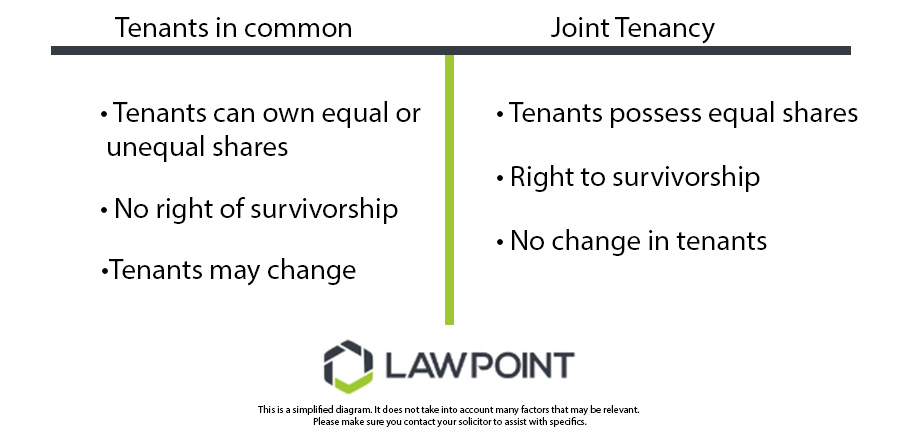

As tenants in common you and the other owner(s) choose to have equal and distinct shares in the property. This can be 50-50, 60-40, 99-1 or any other proportion the co-owners choose. As opposed to joint tenants, if an owner holding a property as a tenant in common dies, their share of the property will be dealt with in accordance with their Will or if they do not have one, the rules of intestacy.

Tenants in common may hold the property in unequal shares. You can divide the ownership of the property however you want and that agreed shareholding is recorded on the title to the property.

Dividing shares in a property unequally may have to do with each party’s contribution to the property where, for example, one owner is contributing a higher proportion of the purchase price or for some other reason such as asset protection. This type of tenancy is generally considered to be more flexible and allows for greater freedom and security.

This type of tenancy is generally favoured where family members or friends purchase together and want to be able to take out what they put into the property. In this type of tenancy, a property’s profits, losses, and risks are split by the defined ownership share as above.

Joint Tenants

In its simplest form, joint tenants mean that upon a joint tenant’s death, their share of the property will automatically pass to the remaining owner(s) of the property. If you own a property as joint tenant, you are not able to leave your share of the property to someone other than the co-owner(s) in your Will.

This type of tenancy is generally favoured by married couples or couples in long term relationships. That is because, the surviving joint tenant who eventually becomes the sole owner is then able to bequeath the property as they choose.

When considering this type of tenancy – ask yourself if you are happy for the property to pass on to the co-owner should you pass away. A lawyer for wills can assist you in making this decision, particularly if you already have a will in place.

This type of tenancy is generally not recommended where co-owners are purchasing a property as a business investment or where you are purchasing a property with friends and you would not wish for the property to pass to that co-owner if you passed away. For more information involving wills, contact a Lawyer for wills.

Mixing Tenancy Types

There is also the option of combining different tenancy types. This is only able to be done where there are 3 or more co-owners of a property.

This may be a more suitable option where there are more than two purchasers, but two of the purchasers happen to be a married couple.

In this case they can own a share and the other owner can own a share as tenants in common but between the couple they may choose to own their shares as joint tenants.

For example, if three owners purchase a property and two of them are married, the married couple can hold their share as joint tenants, so that if one spouse dies, the other automatically acquires their share and the married couple then hold their share as tenants in common with the other owner, who may be a friend or business partner.

Altering Tenancy

If you already are a co-owner of a property and believe that you have made the wrong decision or would simply like to change this, you are able to do so. This is done through a transfer altering tenancy.

The most common scenario where this occurs is where married couples separate but do not divorce or finalise their property split. In that case, one owner may sever the joint tenancy and convert it to a joint tenancy so that if they pass away, their ex-spouse does not automatically acquire their interest in the property.

Tenancy and Taxation Implications

The way that you own a property can also have tax implications. For example, owning a property as joint tenants will result in tax implications being shared evenly. Where a property is held as tenants in common, the tax implications will reflect the ownership share set by the owners at the time the property is acquired.

A property law solicitor is not able to give tax advice so you should speak to your accountant or financial planner about tax implications before you make a decision on tenancy.

Conclusion

There are several different ways to own a property. Your choice will depend on a range of factors including your relationship with the person/s you plan on purchasing a property with. It is extremely important you discuss your personal circumstances and your wishes with your property lawyer so that we can advise you

Liability limited by a scheme approved under Professional Standards Legislation. This post provides a general overview and should not to be relied upon as legal advice or as a substitute for legal advice or as giving rise to a solicitor / client relationship. If you want advice specific to your circumstances, please contact us to arrange an appointment.correctly.